The Silent Collapse: How India’s Local Businesses Are Crumbling Under the Weight of Delivery Startups

India’s small businesses, retail shopkeepers, and local entrepreneurs are facing an existential crisis. While they continue to pay rent, salaries, and overheads, tech-driven startups like Blinkit, Zepto, and Instamart are reshaping consumer behavior with lightning-fast delivery, discounted pricing, and venture capital firepower. Backed by global investors, these delivery giants are operating at unsustainable losses to acquire market share, pushing local players to the brink. In cities like Mumbai, Delhi NCR, Jaipur, and beyond, the traditional business model is collapsing silently—with little to no intervention from the Indian government or competition watchdogs.

India’s Retail Backbone – Now Under Threat?

For decades, India’s economic lifeline has been powered by its kirana stores, small business owners, local malls, and family-run retail shops. These micro, small, and medium enterprises (MSMEs) employ over 120 million people and contribute around 30% to the country’s GDP.

However, the digital revolution and the entry of VC-fueled delivery startups have shifted consumer preferences radically. The promise of 10-minute deliveries, steep discounts, and 24/7 availability is breaking the backbone of these traditional models.

What was once a thriving network of neighborhood shops has now turned into a battlefield—where local players are forced to compete against platforms backed by SoftBank, Sequoia, Tiger Global, and foreign capital flows.

The Rise of Blinkit, Zepto & Instamart – And the Fall of the Local Market:

The model is simple—but dangerous. Startups like Blinkit (backed by Zomato), Zepto, and Swiggy’s Instamart are:

-

Offering 10-minute deliveries of essentials like milk, bread, groceries, and packaged snacks.

-

Selling at discounted or near-wholesale prices, often cheaper than MRP.

-

Creating habitual dependency among consumers who no longer walk to nearby stores.

But here’s the hidden play:

-

These companies are operating at massive losses deliberately.

-

Their goal is not short-term profit—but market dominance and valuation growth for IPO or funding rounds.

-

Blinkit, for example, clocked losses of over ₹1,000 crore but kept expanding via dark stores.

📍 In Delhi NCR, entire blocks of kirana shops are reporting a 40–60% dip in daily footfall.

📍 In Lucknow and Jaipur, mall food courts and snack vendors claim 70% of evening orders now go through Swiggy or Zomato.

📍 In Mumbai and Pune, Zepto has eaten into the margins of even established grocers.

Vendor Pressure, Forced Partnerships & Compromises:

Local food vendors, small restaurants, and wholesalers are not just losing customers—they’re being coerced into joining platforms like Zomato and Swiggy.

But the catch is:

-

These platforms charge commissions up to 30–35%.

-

Vendors are forced to participate in discounts and promotions.

-

Quality and quantity are compromised due to margin pressure.

📌 A small sandwich seller in Bengaluru’s Indiranagar said:

“Either I list on Swiggy or I die. But listing means I earn half per order—and still have to maintain hygiene and fast service.”

📌 A grocery wholesaler in Ahmedabad stated:

“Blinkit and Zepto are offering rates cheaper than I can source from my distributor. How do I compete?”

Even delivery costs are masked via platform service fees, making the final user cost seem low while squeezing vendor margins.

Our research across Mumbai, Delhi NCR, Jaipur, Lucknow, Chandigarh, Kolkata, Chennai, Bengaluru, Agra, Meerut, Bhopal, Ahmedabad, Surat, and Pune reveals a pan-India pattern:

-

Tier-1 cities: Major drops in foot traffic in local stores and eateries.

-

Tier-2 cities: Shops are shutting down after 20–30 years of stable operation.

-

Tier-3 and beyond: Delivery platforms are expanding aggressively, using local partnerships and dark stores.

In cities like Surat and Bhopal, vegetable vendors and general store owners are now reporting that families no longer come out for weekly shopping—they just order from apps.

The most aggressive market disrupter is Blinkit, which is rapidly setting up dark stores every 3–5 km to ensure delivery coverage. Zepto, targeting youth and working professionals, is expanding in tech-savvy urban pockets. Instamart benefits from Swiggy’s existing delivery network.

Together, they’re creating a new market—but destroying the old one.

If This Continues...

If the current scenario continues without intervention:

-

India will see a mass extinction of small retail businesses in the next 3–5 years.

-

The country’s dependency on a handful of foreign-funded, loss-making companies will increase.

-

Employment in informal sectors will plummet—especially for non-tech-savvy workers.

-

Data-driven pricing will kill bargaining power and traditional wholesale markets.

Startups may argue they’re creating jobs—but delivery jobs are:

-

Low-paying,

-

Gig-based (no stability),

-

And often replace full-time local employment.

The economic power of India will slowly shift from lakhs of entrepreneurs to a few tech monopolies.

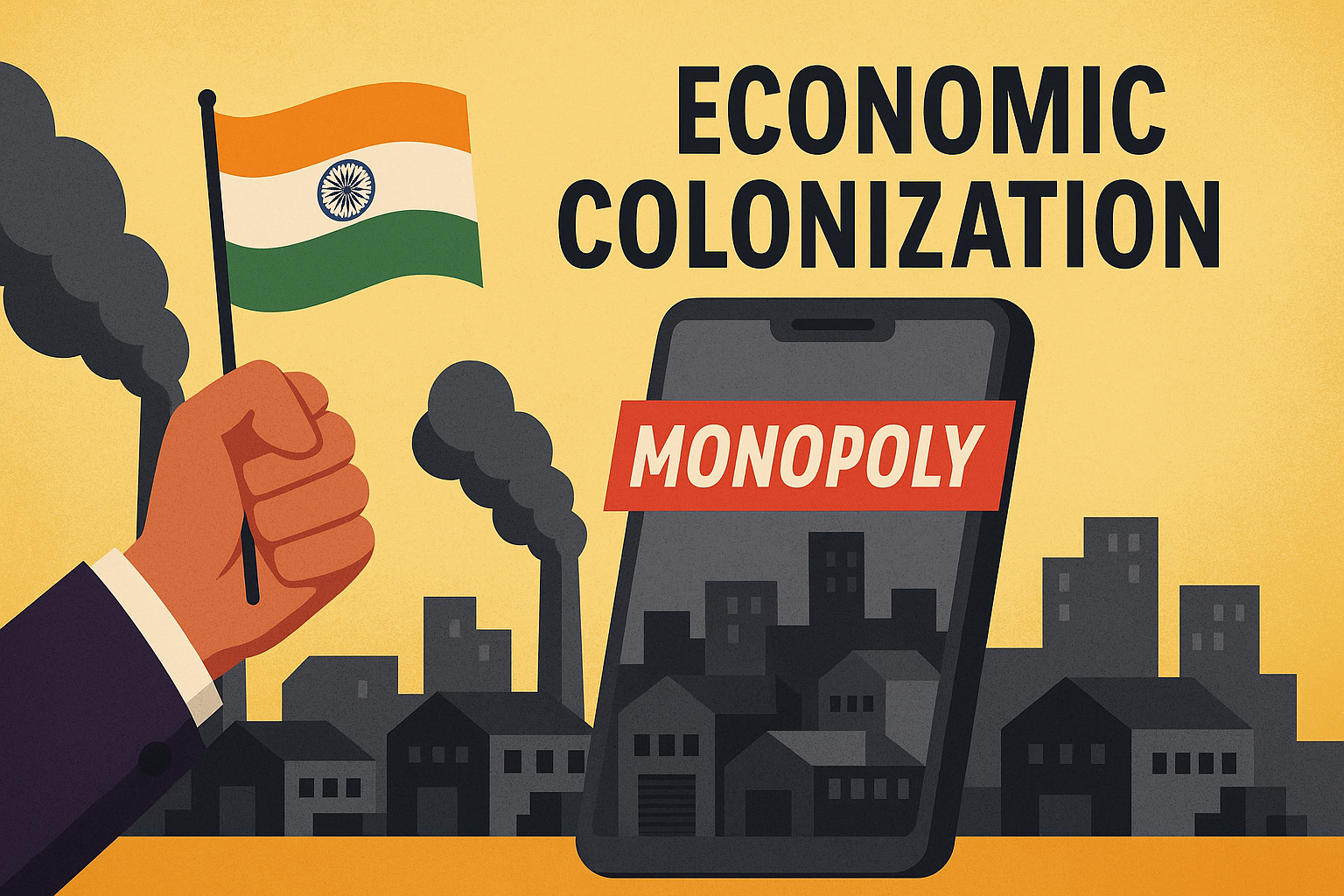

This Is Not Innovation—This Is Colonization 2.0

This is not just a market shift—it’s systemic capture. Backed by billions in VC funding, these startups are executing a classic "dumping" strategy:

-

Sell cheap,

-

Destroy competition,

-

Gain monopoly,

-

Then raise prices and reduce quality.

What we’re witnessing is economic colonization through apps and dark stores.

India’s entrepreneurial spirit is being smothered not by incompetence—but by policy blindness and regulatory inaction.